Each quarter the market faces the same question: should I buy, sell, or wait? The current Q3-25 quarter is no exception and is on track to deliver a substantial Seller's premium as the laws of probability have played out.

Last quarter in Q2-25, the Seller's premium was negative, as the spot price delivered a higher price than expected by the forward market. In Q1-25, the Seller's premium set record highs because the spot price was so soft compared to pre-quarter market expectations. As we enter the final week or so of this quarter, the pre-quarter selling price remains well ahead of the realised spot price, setting-up for a significant Seller's premium. A full wrap-up of Q3-25 will appear in our September monthly report.

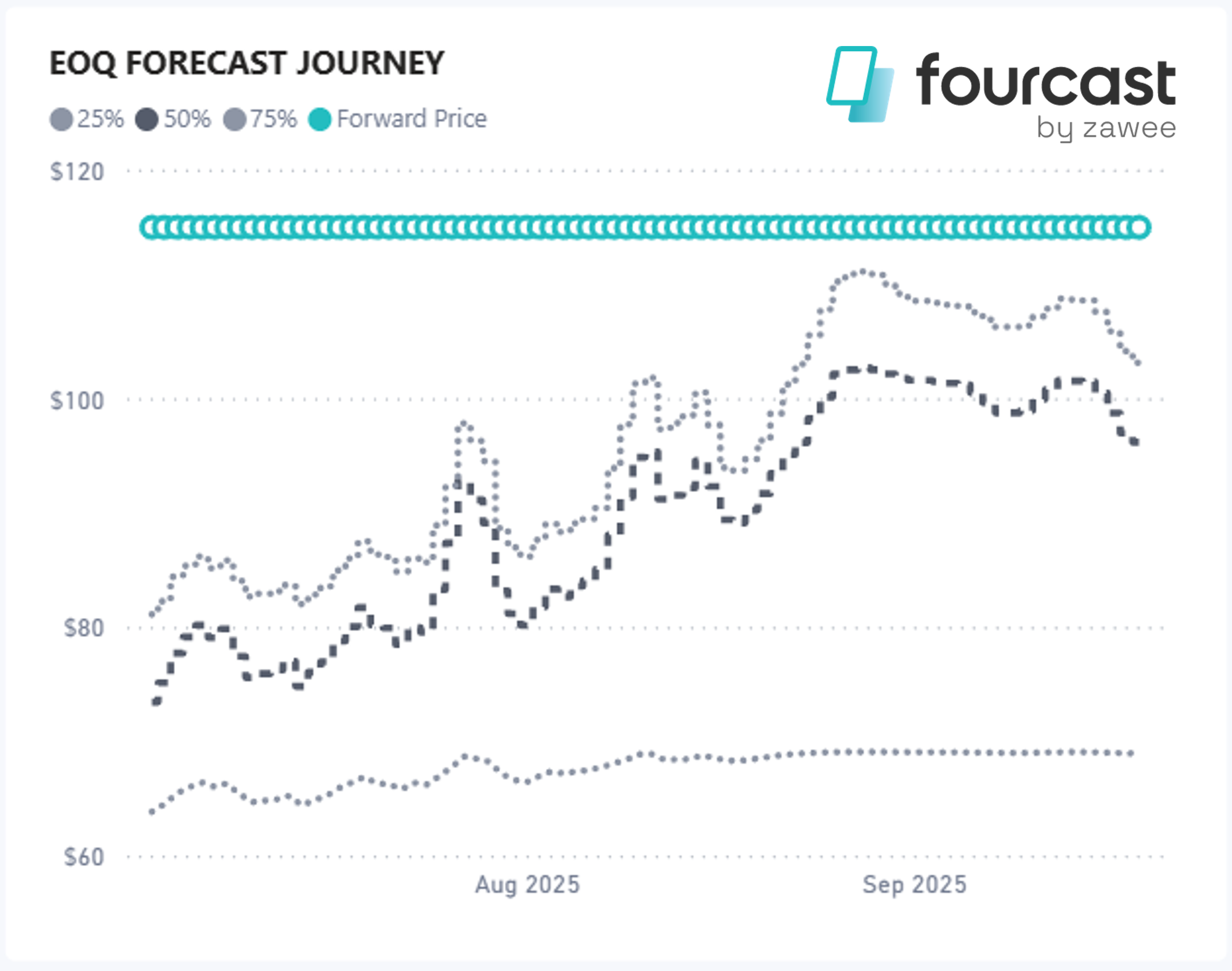

For now, we thought it would be useful to show the forward market journey throughout the quarter, and show how the daily forward settlement price has tracked against our “fourcast” probabilistic spot-price system outlook, accompanied by our complementary Learning Model. This model refines the forecast learning from each trading day leveraging the known outcomes. Together these tools provide a live valuation of the quarter which can lead to proactive trading throughout the quarter.

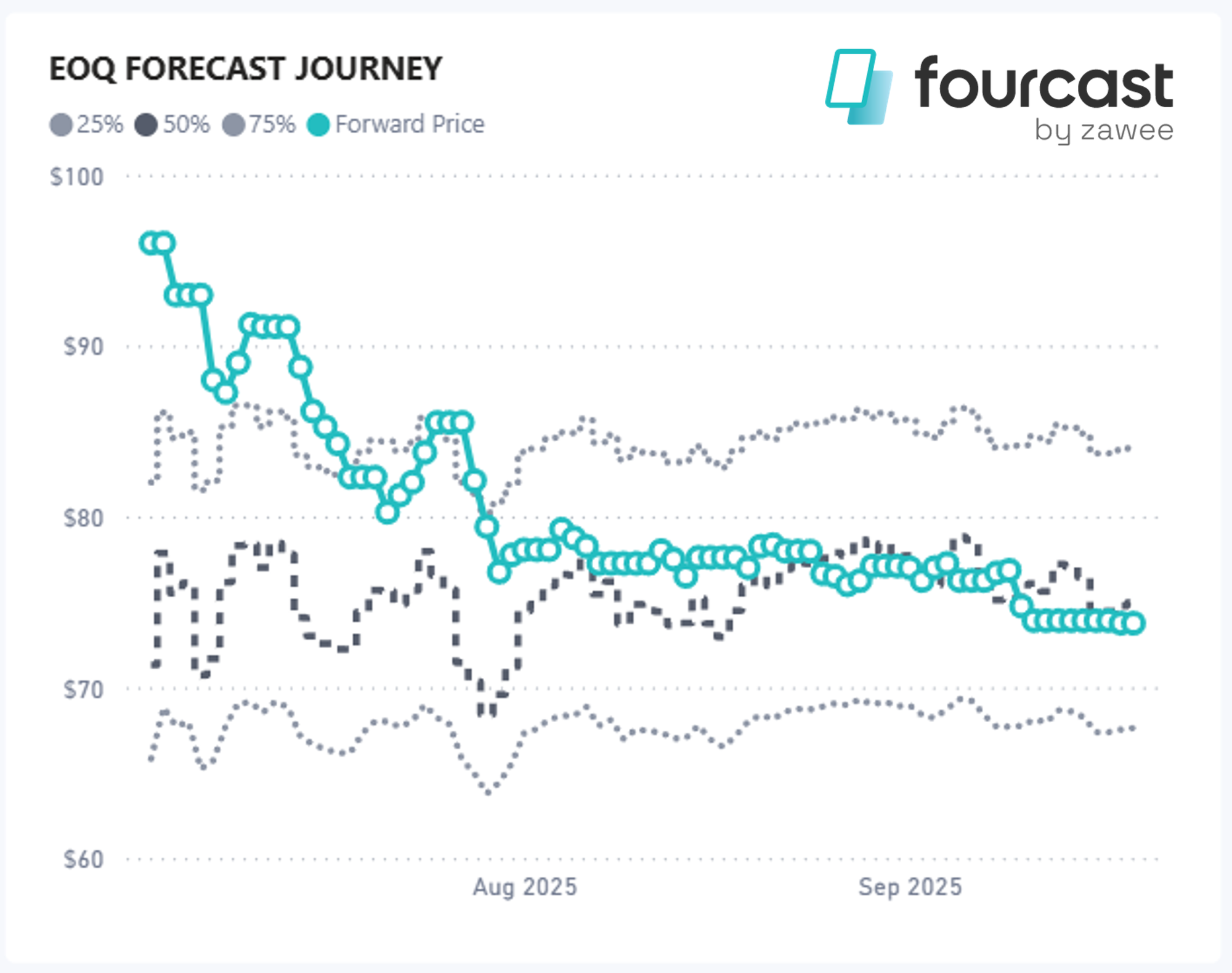

Queensland

The chart below shows the daily forward price (blue circles) through each day of the quarter and then our median forecast (dark grey), accompanied by the 75th and 25th percentile forecasts (grey dotted lines).

In Queensland the forward contract opened at $96/MWh, while our median forecast immediately indicated most likely over-valuation in the low-$70s. The forward price slid to $77/MWh by 6 August, stabilised for a month and then fell again on 10 September to just under $74/MWh.

Our model median forecast stayed largely between $70 and $75/MWh during the month, dipped below $74/MWh in mid-August and now sits almost exactly on the forward price at $74/MWh. The market has therefore converged on our initial valuation, although some late-quarter volatility remains possible.

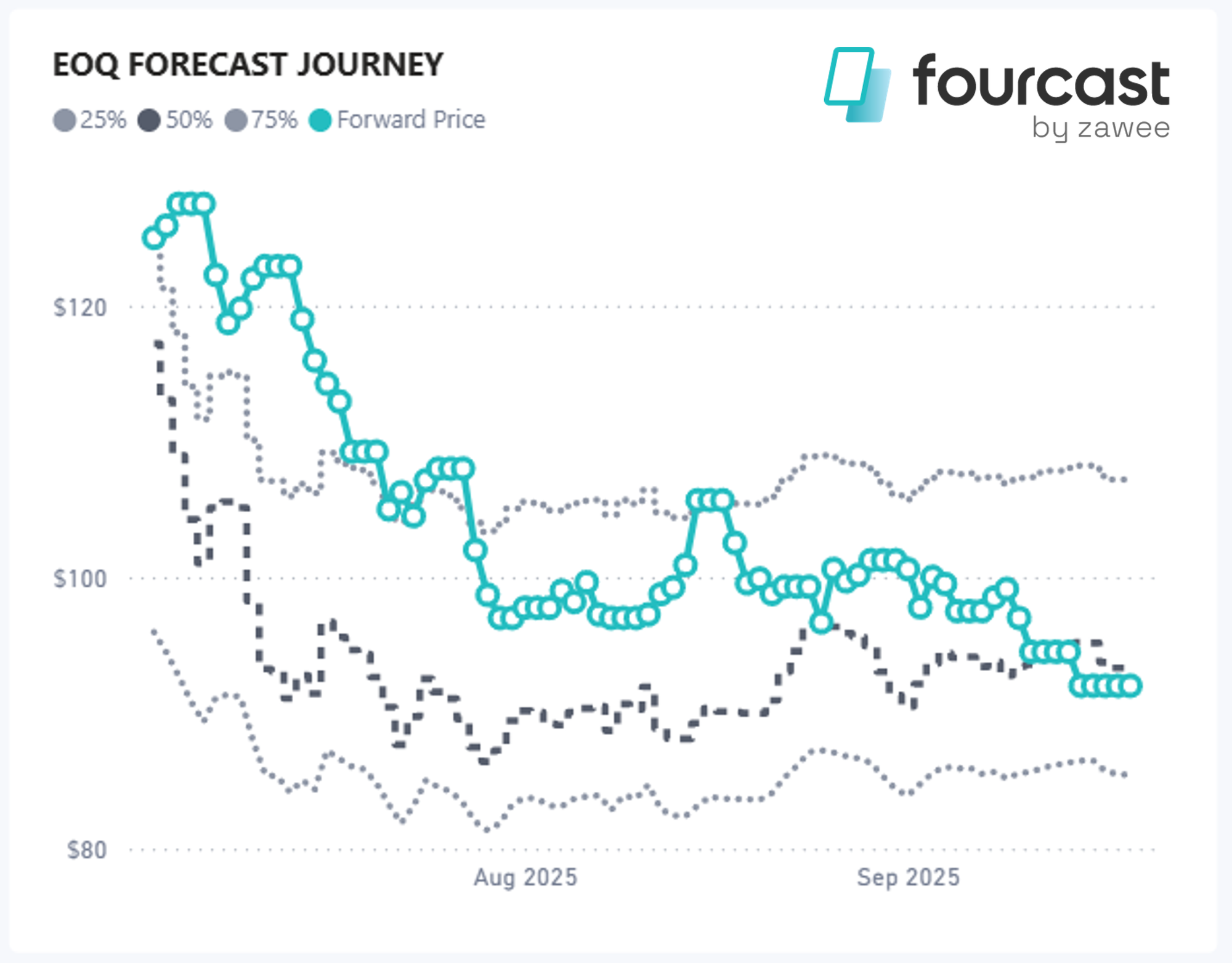

New South Wales

New South Wales followed a similar pattern. The forward market started at $125/MWh, briefly peaked at $127.50 and then trended lower towards $92/MWh.

Our modelling median forecast began at $117/MWh, slipped quickly to $86.50/MWh by 29 July, climbed back to $96/MWh on 26 August and has since oscillated between $90 and $95/MWh. The forward market and our median forecast values met on 11 September at roughly $94/MWh and have both eased to around $92/MWh. The repricing confirms that the apparently generous opening level was, as our probability-weighted view suggested, unlikely to persist.

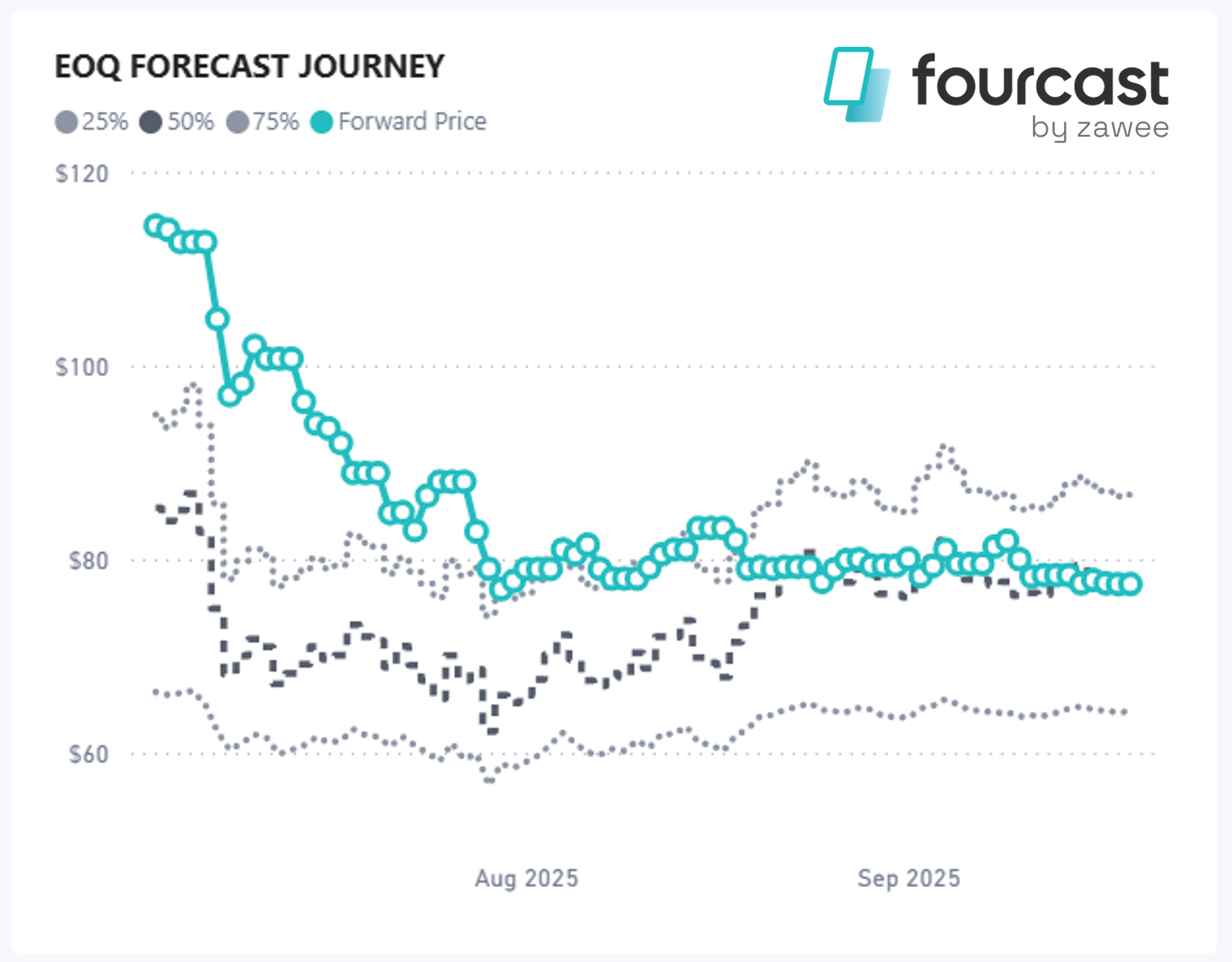

Victoria

Victoria forward market opened above $114/MWh, whereas our fourcast model saw fair value nearer to $85/MWh. The forward market rapidly followed New South Wales trend, touching just under $77/MWh by early August, rebounding to $83/MWh later in the month and settling again at around $77/MWh.

Our median forecasts fell even faster to $62/MWh early in July, hovered around $70/MWh, and then firmed into the high-$70s/MWh. Since 22 August our median model forecast and the forward curve have been virtually identical in the high $70's/MWh then tracking downward softly to about $77/MWh. The initial premium has been fully eroded unless an extreme event occurs in the last days of the quarter.

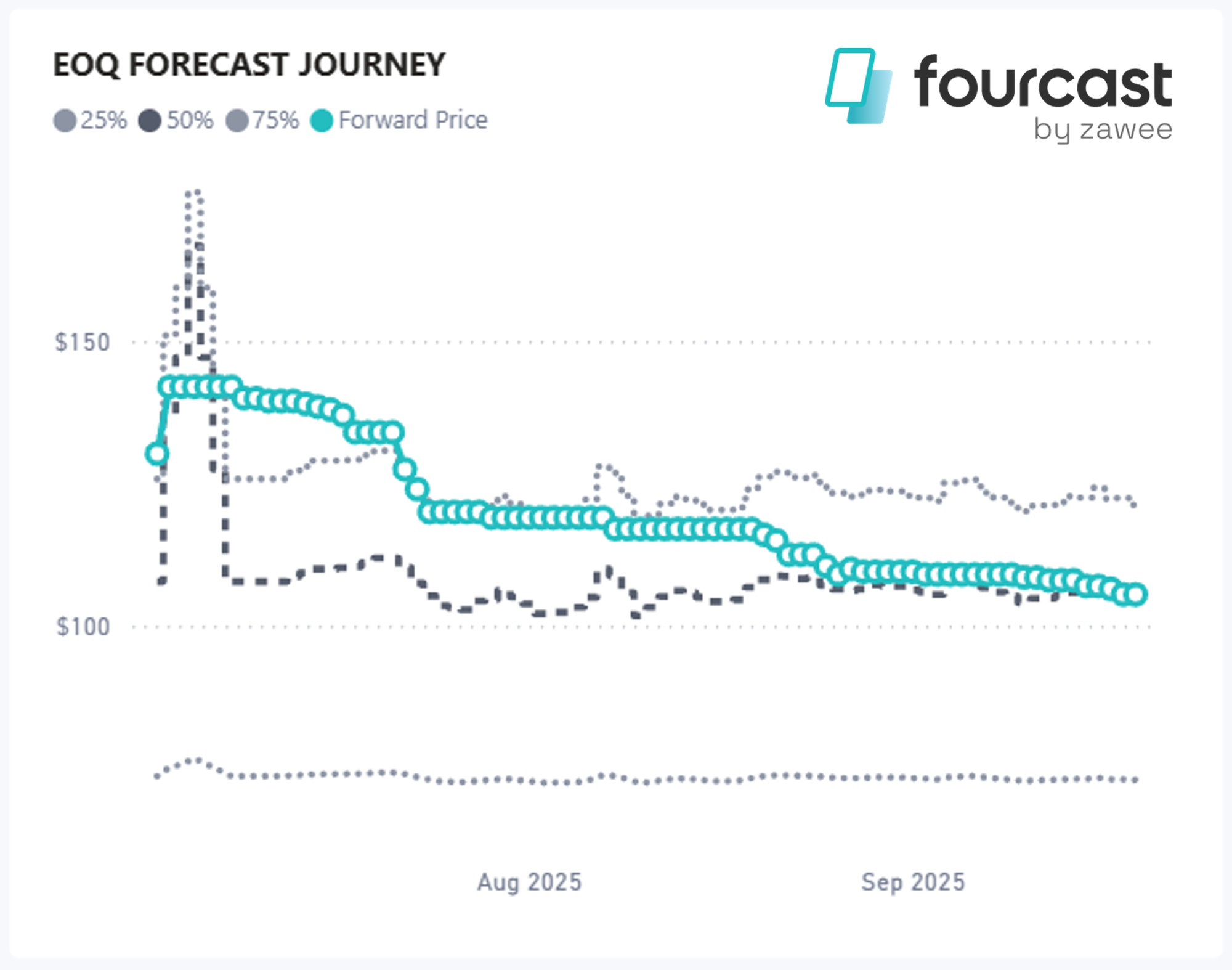

South Australia

South Australia forward market began the quarter with a price near $130/MWh, had a brief spike to $142/MWh on early extreme spot outcomes, and then glided steadily downward to about $105/MWh.

Our median forecast opened at $107/MWh and, from 22 August onward, moved to within $4/MWh of the softened forward market. By 16 September the two series were fully aligned near $107/MWh. The early volatility premium has largely disappeared.

Tasmania

The Tasmanian market does not trade through the quarter on ASX Energy, so looking at the last price offered before the quarter started, the offered price was almost $115/MWh.

We regarded the forward price as distinctly over-valued, given our starting median forecast was near $77/MWh, and our 75th percentile at $81/MWh. As HydroTas pursued strategic water releases, spot prices lifted and our model's forecasts followed. Our median forecast peaked around $103/MWh on 26 August before easing to $96/MWh by mid-September. Quarter-to-date spot prices have averaged less than $100/MWh, implying that the final outcome will lie between our early valuation and the structural upward movement.

Conclusion

Predicting spot-price outcomes is never a binary exercise, which is why we rely on a probabilistic framework and seek risk-adjusted hedging using our watt.if optimisation engine. This quarter demonstrates how an apparent rich forward curve can normalise over time, and on occasions can reward early Sellers. However, significant value can be derived by actively trading through the quarter as no two quarters are necessarily the same. Optimising the deployment of risk capital for the best prize throughout each quarter's journey is the game plan.

I have written an article about our Portfolio Optimisation Science which can be found on our energybyte platform; and if you can push through a bit of academic discussion, hopefully you can find the technique interesting and valuable.

We would be happy to chat further.

Carl Daley

Managing Director

carl.daley@zawee.com.au