The extreme price events driven by yesterday’s Triple ‘C’ Day have now reset price expectations and the perception of risk for the remainder of the quarter and beyond.

Prior to this week, Q2-25 was tracking to follow in the footsteps of Q1-25 by struggling to live up to price expectations. Consequently, forward prices were softening, and this downward shift in perceptions not only impacted Q2-25 but flowed through to subsequent quarters. Yesterday's Triple ‘C’ Day of cold, calm, and cloudy conditions led to little wind generation, and when combined with base load outages at Yallourn, Loy Yang A, Bayswater, Callide B, and Gladstone, created the recipe for extreme prices during the evening peak.

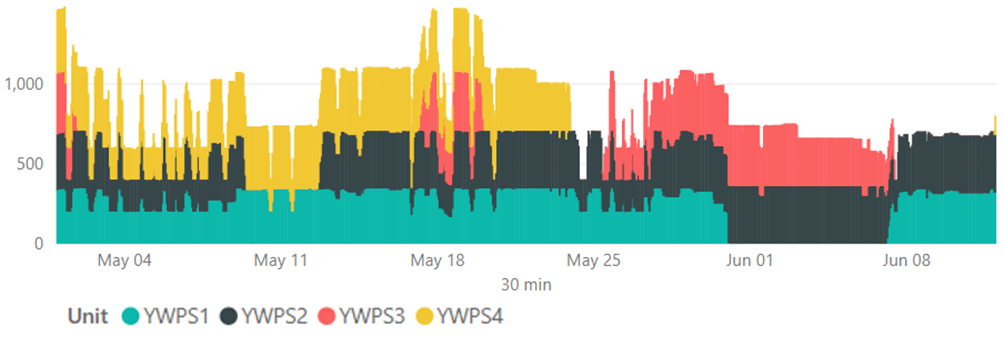

Yallourn continues to have a troubled availability run, as shown below. Unit 4 came back online early this morning.

Last night, during the evening peak, all regions remained unconstrained, and so the extreme prices occurred across the NEM. This coincidence is more common during winter and less common in summer, where price separation between the northern and southern regions regularly occurs.

At one point last night, the NSW-VIC interconnector had only 17MW of spare capacity, and energy was flowing into NSW. There was a very high chance that price separation between the northern and southern states would follow. However, following an extreme price signal, NSW demand dropped, causing the NSW to VIC interconnector flow to reverse into VIC. This caused VIC spot prices to sit on the top of the price stack, which kept the states unconstrained, delivering highly correlated spot price outcomes throughout the peak.

Here is a chart showing the half-hour spot prices across the NEM during the evening peak.

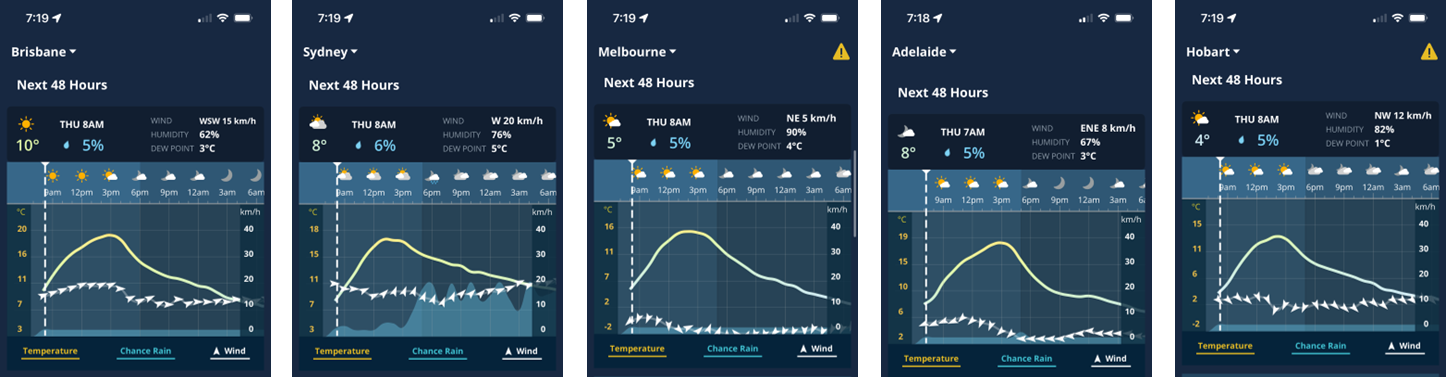

Looking at the prognosis for the next few days from WeathwerZone, the weather forecast shows cooler weather persisting in the southern states with little wind. The northern states show warmer weather arriving, however, with only gentle winds.

Tonight’s evening peak forecast looks stronger than yesterday’s evening peak 24 hours ago, so it will be another testing day in the market.

When the ASX Energy market opens today, it will no doubt jump upward given what has transpired yesterday and the threat of events being repeated.

The following figures show our probabilistic spot forecast for the quarter, and the needle on each dial and bold value show last night’s closing price for the quarter as at 4:00 pm.

- For QLD, the base swap was in the bottom quartile, which will now nudge closer to our 25th percentile.

- The QLD cap payouts are in our second quartile and will move upward closer to our median.

- For NSW, the base swap was already near our 25th percentile and will now jump over into the second quartile.

- NSW Caps were already sitting above our median in the 3rd quartile and will now move upward.

Looking at the southern states:

- VIC base swap was located in the bottom quartile and will now strengthen.

- VIC Caps were trading almost matching our median forecast as at the end of the trading day and will now sit above our median.

- SA base swap was very close to our 25th percentile and is expected to finish around the same mark by quarter end.

- SA caps have dramatically softened during the quarter and are matching our median forecast, and it is expected to be slightly elevated by the end of the quarter.

This week will be a defining time for the market, impacting perceptions for the current quarter and next quarter in particular.

Enjoy the ride.

Disclaimer and Notes

Energybyte is published by Empower Analytics Pty Ltd (ABN 38630239002), Authorised Representative no 1274453 of Capital Treasury Solutions (AFSL 429066). Any questions or feedback must be directed to Empower Analytics Pty Ltd as the sole publisher.

This newsletter contains general information and is not advice to buy or sell any position.

Empower Analytics has exercised professional care in the preparation of this newsletter, the information includes data from third parties which is not independently verified and it is current at the date of publication. Empower Analytics is under no obligation to update this data.