The forth coming summer will be the next pivotal point in the market. Perceptions of the risk have softened and the Q1 quarter price has heavily traded down. Will summer bite and short players get sunburnt, or will Cal-26 and onwards reflect a lower risk premia?

In bygone years, the Q1 forward market price set the tone for the whole year and was top of the price stack of the whole year. Except for QLD, that crown has been passed over to Q2 since the Global Energy crises of 2022.

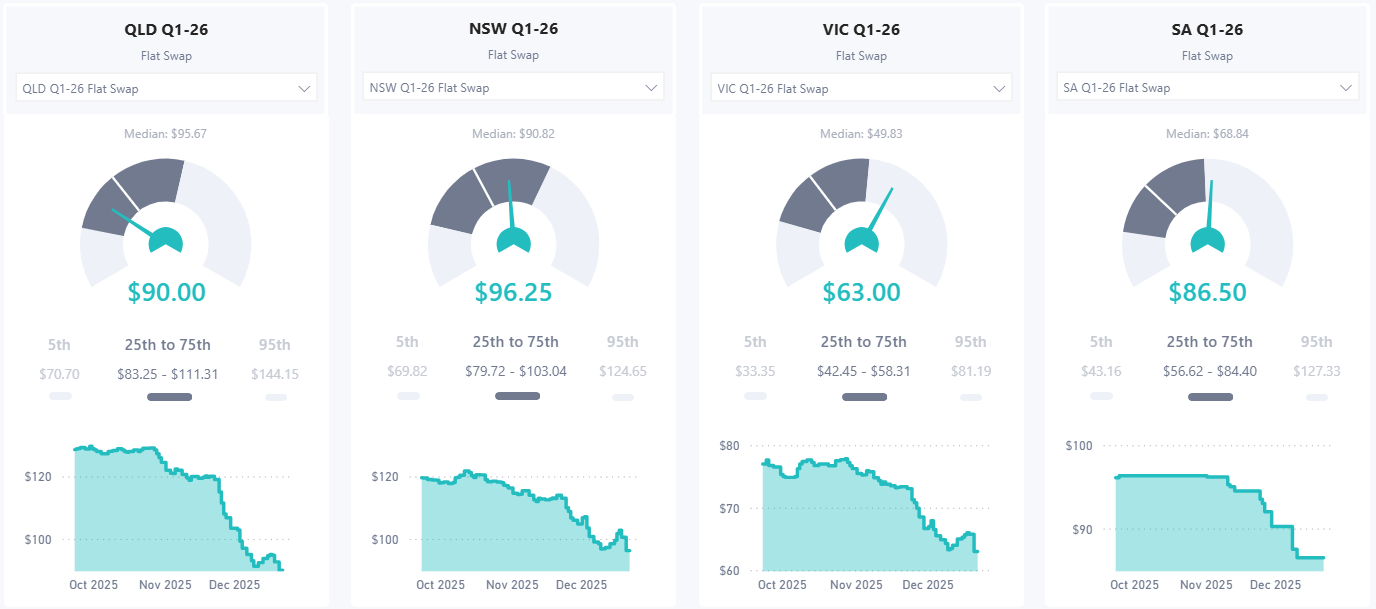

Q1-26 Forward Price Movements

Over the past few weeks, it would be an exaggeration to say that the Q1-26 forward prices have been in free-fall, but there has been a material shift of expectations. Over the last 3-months:

- QLD Q1-26 which peaked at over $129/MWh in late October, fell through the $110/MWh floor, and then pushed further down through the $100/MWh floor, and now is trading around $90/MWh

- about 10-weeks ago, NSW Q1-26 was trading at $121.75/MWh and then has proceeded to push through the same floors and is now approaching $96/MWh

- VIC Q1-26 reached a high of $77.85/MWh in late October but now has pushed through the $70/MWh floor to be trading around $63/MWh

At some point, there may be some resistance, and the buyers will step-in unless the early January spot prices are soft, despite the BoM hotter-than-average weather forecast.

Looking at our own probabilistic spot forecast, we note that:

- QLD is below our median forecast and therefore is more likely to rise than fall, although Q4-25 will finish in our bottom quartile so recent history suggests QLD has an increasing propensity to be soft with more renewables online, and BESS' having an impact

- NSW is sitting comfortably in our fair value region, that is between the median and 75th percentile. Actual spot prices rolling through January will soon become the big perception driver

- VIC is comfortably above our 75th percentile and after updating our forecast a week or so ago, we now have VIC facing a lower spot outlook in Q1-26. The Q3-25 quarter will likely finish around our 70th percentile, so if Q1 follows suit, it will track below $60/MWh

- SA is just above our 75th percentile so has the potential to soften further when traded

Lesson from History

It was 24 years ago in 2001, when a trading house thought the prized VIC Q1 was steeply over-valued and they began to sell, and did so with scale. The physical market players (that is those with generation), thought at those levels it was good buying value and began to buy, and did so with scale.

Once the quarter started, the generation sector revised their spot strategy and placed more capacity in the higher price bands. Consequently, the capacity was still available, but it was at a different price and at-risk of not being dispatched.

Classical Melbourne heatwaves struck with the first case causing heat stress for tennis players during the Australian Open. Other hot days followed and Q1 2001 delivered 15 days above 35 degrees that has only been matched twice before (2013 and then again in 2025). The record stands at 16 days set in 2019.

The average VIC Q1 in 2001 spot price finished at $59.73/MWh, which is just more than the last 4-years of 2022 to 2025. However, back in 2001 the Maximum Price Cap was $5,000/MWh. Using an art and science technique to normalise historical spot prices to the current Market Price Cap of $20,300/MWh, places 2001 as the second highest average VIC Q1 average price at about $117/MWh, second only to 2019 with a $185/MWh normalised average price.

In summer of 2001, VIC spot prices soared (relatively speaking) and separated from NSW. Inter-regional hedging using NSW hedging products to protect a VIC short position was ineffective. The VIC buyers captured a handsome profit and few months later, the trading house folded.

The lesson from 2001 is that it is always a dangerous strategy for financial market players to take on the physical spot price-setters.

Why Has Q1-26 Expectations Changed?

Over Q3-25 and Q4-25, NSW has experienced the most frequent spot price volatility, or the threat of volatility. However, even NSW volatility has been lower than expected evident by the falling of the $300/MWh cap value during the quarters, and therefore the perception of the risk has lowered.

Except for Q2-25, selling $300/MWh caps this year has been a successful trading strategy, and as I recall Q1-25 delivered the highest Sellers profit in history. These outcomes have fed into lower perceptions of risk.

NSW and QLD inter-regional spread has also changed over the last 2-years, especially during the evening peak. Two years ago, QLD was at a premium to NSW during the critical evening peak, but this year, even without many of extreme price events being realised, NSW holds the evening peak premium.

Since 2023, NSW and QLD Q1 forward prices have traded in close proximity, alternating for top position. For Q1-26, this relationship has now flipped from QLD holding the premium to NSW, and therefore more resembles the relationship found during 2023 for the same quarter.

Looking Forward for Summer

If Q1-26 cannot deliver value, then the rest of the year will be impacted and forward prices for subsequent quarters and 2027 is likely to track-down. However, if the spot market can bite, then as always it will send shock waves through the forward curve and prices are more likely to rally.

Enjoy the summer ride and don’t forget to protect yourself and your business.

Changing the topic, cancer is a serious issue in Australia, and everyone knows someone who has been impacted or you may have been impacted your self. Look after your self, especially over summer.

We have taken the liberty of tweaking the Cancer Council message about skin cancer for the electricity market ...

Thank you and All the Best

Finally, we thank all our supporters and we wish you and your family all the best during this Festive Season, and we look forward to another successful year in 2026.

In the chart pack following there are some handy insights showing:

- History of Q1 spot prices

- Normalised VIC Q1 spot prices

- NSW-QLD Inter-Regional Spread

- NSW Spot Volatility

- Q1-26 Forward Prices

History of Q1 Prices

The chart below shows the historical Q1 average spot prices since 2000, and you can deselect any Region to highlight the focus.

TAS holds the Q1 average price record when BassLink broke in 2016, closely followed by QLD in the same year. QLD has been amongst the leaders over the last 5-years (you can swipe the chart to make this point more obvious), but Q1-26 has no guarantee to follow suit.

The last time SA 'flexed' it's Q1 muscle was in 2019 but since this time, structural changes have transpired. It has also been a long time since VIC delivered a strong Q1 price, despite transmission towers being knocked-over in February 2024.

Normalised VIC Q1 Spot Prices

The normalised spot price for average Victorian Q1 prices are shown below where the normalisation process adjusts for changing Maximum Price Cap (or VoLL) over the years. That is a $3,000/MWh spot price occurring with a MPC of $5,000/MWh is unlikely to be repeated under a $20,300/MWh MPC. The process to normalise is a judgement call and cannot be too precise because it is attempting to model strategic behaviour which at the best of times, is problematic.

The key message is that 2001 Q1 prices were amongst the highest on record on a comparative basis.

NSW-QLD Inter-Regional Spread

Looking at the Inter-Regional spread between NSW and QLD categorised into time-of-day bands, it is noted:

- the biggest value shift has been during the evening peak (16:00 to 20:00 hours), where 2-years ago QLD held a $25/MWh premium to NSW. In 2025, this has reversed where NSW has delivered a $40/MWh premium and this excludes the realisation of extreme prices that could have occurred last week (see next chart for detail)

- the NSW premium for the morning peak (06:00 to 10:00 hours) and daytime (10:00am to 16:00 hours), has reverted downward to similar levels experienced in 2023

- finally, the late evening prices is now at a NSW premium to QLD

NSW Spot Volatility

Last week threatened extreme prices were evident from Thursday 18 Dec-25 through to Sunday 22 Dec-25. It is unusual to have such a threat of volatility so close to Christmas, but the market has a track record of re-writing history.

Extreme prices at or near the Maximum Price Cap were shown in the predispatch as at 8:00am each day, and then as the day unfolded, the risk dissipated; although Thursday did reach almost $5,000/MWh for a half hour, and on Friday exceeded $5,000/MWh for another half an hour. This analysis was undertaken on a half-hour basis to align with the predispatch time periods.

You can swipe the chart for improved clarity and de-cluttering of labels.

Tracking of Q1-26 Forward Prices

The history of the Q1-26 forward prices is shown below for each Region since 1 Oct-25. As mentioned earlier, the prices have moved through previously perceived floor prices, especially the northern Regions of QLD and NSW.

- QLD peaked at over $129/MWh in late October, and now has fallen to around $90/MWh; the largest fall of all Regions

- NSW peaked mid October at $121.75/MWh and now is approaching $96/MWh

- SA is not as liquid and therefore not as responsive, but it too has softened from above $96/MWh to $86.50/MWh and when trades again, is likely to be lower

- VIC peaked at $77.85/MWh about the same time as QLD, but then has softened bottoming-out at $63.25/MWh, before rallying to $66/MWh, but is now softening again to $63/MWh

- TAS seems to be disconnected to the events on the mainland and was offered at at about $81.50/MWh and is now slightly lower at $78.70/MWh

Disclaimer and Notes

Energybyte is published by Empower Analytics Pty Ltd (ABN 38630239002), Authorised Representative no 1274453 of Capital Treasury Solutions (AFSL 429066). Any questions or feedback must be directed to Empower Analytics Pty Ltd as the sole publisher.

This newsletter contains general information and is not advice to buy or sell any position.