The market is entering the most risky Spring stretch this year, potentially repeating history for the last week of November flexing its muscle. Hot weather in NSW and QLD combined with significant baseload outages are the ingredients in the volatility recipe.

Executive Summary

At the time of writing this report, New South Wales’ projected reserve level is expected to drop to 700MW today, before climbing back to over 3,200 by the weekend. Queensland follows suit, shrinking to about 1,100MW today before climbing back to at least 2,800MW by the weekend. In contrast, the Victorian and South Australian reserve levels looks plentiful.

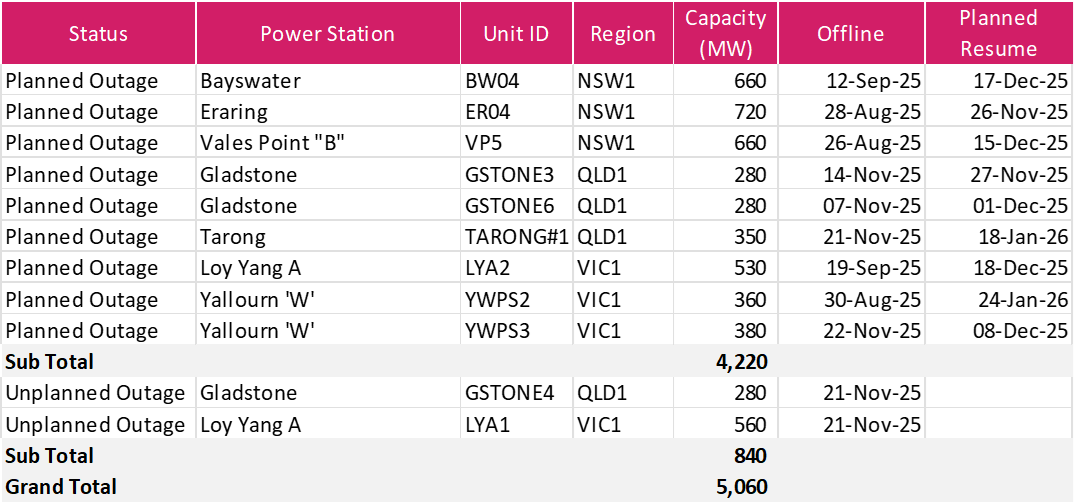

Whilst this period remains as typical 'outage season' there are 9 coal-fired units with planned outages representing 4,220MW, plus 2 unplanned outages representing a further 840MW, taking the total to 5,060MW of capacity offline.

History reminds us that the final week of November often delivers sharp, price spikes; since 2002 the 23–30 November window has produced 33 calendar-day events with at least one five-minute interval above $5,000/MWh, 14 of them since 2012. With the Maximum Price Cap (MPC) now at $20,300/MWh and temperatures forecast well above average in Sydney and Brisbane, the ingredients for another bout of volatility are firmly in place.

Current Supply–Demand Balance

NSW is operating without Bayswater 4, Eraring 4 and Vales Point VP5, and with higher demands sees its reserve slide to 700MW today before climbing. QLD is operating without 3 units at Gladstone and 1 unit at Tarong and is facing summer type temperatures later in the week.

Victoria reserve levels remain plentiful despite 2 units at Loy Yang A and 2 units units at Yallourn being offline.

Weather Outlook in Context

The temperature outlook for 24–28 November flags a challenging week, but with some notable weather updates since yesterday. Brisbane begins relatively mild at about 26 °C today before climbing to 33 °C on Tuesday and Wednesday and then spiking to 36 °C on Thursday and Friday. This is around 5 to 8 °C above the ten-year norm and potentially 7 °C hotter than last year’s late-November readings. Sydney is on track for a sharp 35 °C peak on Wednesday, about 6 °C above the decade average.

Melbourne opens warm (27 °C for today, 25 °C tomorrow) but cools to about 19 °C by Thursday which is roughly 8 °C lower than the week’s start. Adelaide looks milder than projected yesterday with the high now tops out near 24 °C on Tuesday and then settles in the low 20 s, easing pressure compared with earlier, hotter projections.

Forward-Market Trading

Since the beginning of October, liquidity in the Q4-25 contract has swung decisively toward optionality. From 1 October to 22 November the Q4-25 contract changed hands for a combined 9,626 MW, of which 4,946 MW (about 55 %) were Options, 3,062 MW Swaps and 1,618 MW Caps. Exchange-for-Physical (EFP) transactions have been removed from these tallies, so the figures represent purely on-screen and brokered futures activity. The dominance of Options highlights participants’ preference for convex, limited-downside cover as the market approaches its most weather-sensitive weeks.

Between the final trading day of September and 21 November, Q4-25 flat-swap prices lost ground in all three mainland regions. In Queensland the contract opened at $98.00/MWh, slipped to a low of $68.60/MWh in mid-October, and on Friday was $74.25/MWh, still materially softer than the starting point but closer to the bottom than the top, of its $29/MWh trading range.

New South Wales followed a similar trajectory, beginning at $104.50/MWh, touching $83.50/MWh at its trough, and closing on Friday at $87.35/MWh, a decline of about $17/MWh from the end-September level.

Victoria moved in sympathy, starting at $52.50/MWh, dipping to $47.10/MWh on last Friday; after peaking at $57.00/MWh in late October.

Driving the softening forward price of the quarter has been the delivery of the actual spot prices. Benchmarking the latest Q4-25 settlements against the average spot price recorded between 1 October and 23 November shows a forward premium of roughly $15/MWh in NSW and $17/MWh in QLD, but a much smaller amount $3.20/MWh in VIC. The surge in Option buying reinforces this view: market participants are willing to pay for insurance against extreme spikes, yet they remain reluctant to lock in higher flat swap prices for the whole quarter.

A Two-Decade Catalogue of Late-Spring Extremes

A recap of history between 23 and 30 November shows:

- NSW has chalked up 62 five-minute prices above $5,000/MWh since 2002; 32 of those occurred on 27-Nov-2024 when the state hit the $17,500/MWh cap fourteen times and averaged $1,033/MWh for the day

- SA’s most acute late-spring trauma dates to 26-Nov-2004, when nineteen cap-bursts drove the daily mean to $700/MWh when the maximum cap price was $10,000/MWh

- Queensland’s worst late-spring episode remains 27-Nov-2009, where fourteen intervals cleared above $8,700/MWh when the price cap was also $10,000/MWh

- Tasmania has not escaped, suffering five capped intervals (i.e. $14,700/MWh) during the danger week, most recently in 2019 amid Basslink constraints.

We wrote an article about last year's November events which can be found at Nov-24 Price Spikes.

Could 2025 Echo the Past

The 2025 set-up shares the essential hallmarks of high volatile risks: high ambient temperatures in NSW and QLD, material coal outages, and downward-drifting reserves which may recover in time. Conversely, the cool change forecast for Melbourne and Adelaide affords Victoria and South Australia some breathing room, though history shows SA remains vulnerable to short, violent price outbursts when wind falters and Heywood is constrained.

Conclusion

If the past is any guide, this week is a heightened risk week for the Spring season and we will watch with interest to see how it plays out.