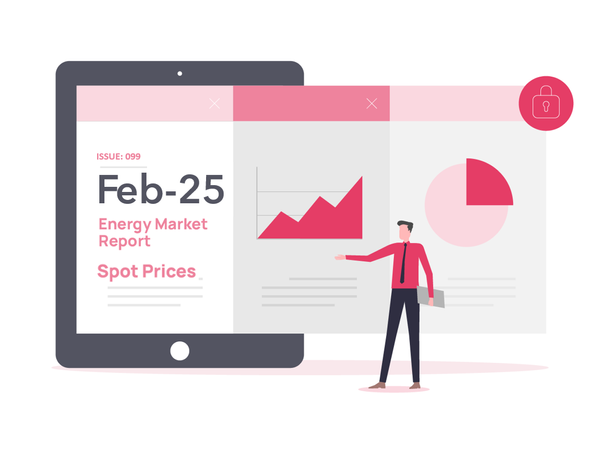

Market

public

Thu 26th June 2025 Event

Last night delivered severe market price conditions. Triple ‘C ‘Day weather conditions (cold, calm, cloudy) eliminated wind generation and drive peak heating demand. This event shifts market price perceptions as well as being both a warning and a roadmap, for building a more resilient energy future.

10 min read